Introduction to Financial Technology in South Africa

Team Leader: Jake MacDonnell

Analysts: Ranem Bakhit, Victor Chan, Aman Kular, Claire Okrainetz, Brandon Robinson, Matthew Tai, Shaha Yousafzai, Sigma Khan

Keywords: South Africa, Economic Growth, FinTech.

Economic Overview

South Africa is Africa’s largest economy based on GDP and contributes to a quarter of the continent’s total GDP. However, the economic prospects of South Africa remain stagnant with little to no economic growth expected for 2016. According to Rand Merchant Bank's Bureau for Economic Research, confidence in South Africa from a financial and investor point of view is the lowest it has been in 5 years. In 2016, unemployment remains the most challenging of South Africa’s economic struggles. Investment from the private sector has been limited, hindering job creation and pushing unemployment to a rate of 26.6%, compared to an average of 11% for similar upper-middle income countries. Although South Africa has been making great strides, there are still many problems facing the country including skills shortages, frequent strikes, strict labor laws, high unemployment, income inequality, growing public debt, political mismanagement, a low education rate, increasing crime and electric shortages.[1]

The largest sector of South Africa’s economy is the service industry which combined for 68% of GDP in 2014. The service sector can be broken down into subcategories to further understand the industries that contribute the greatest to the South Africa’s economy; these includes financial and business services (20.5%), government services (17%), trade, catering and accommodation (14.8%), transport, storage and communications with (10%), and social/personal services (5.7%).[2] Other contributing factors to South Africa’s GDP in 2014 (besides the service industry) included manufacturing (13.3% of total) and mining (8.4%).

South Africa has one stock exchange that ranks among one of the top 20 worldwide by market capitalisation with 393 companies listed at the end of 2015.[3] Today, the largest firms in South Africa are the Anglo American Corp, Sanlam, Liberty Life, Rembrandt, and Old Mutual. Together, this conglomerate controlled 44.6% of the Johannesburg Stock Exchange in 2007.

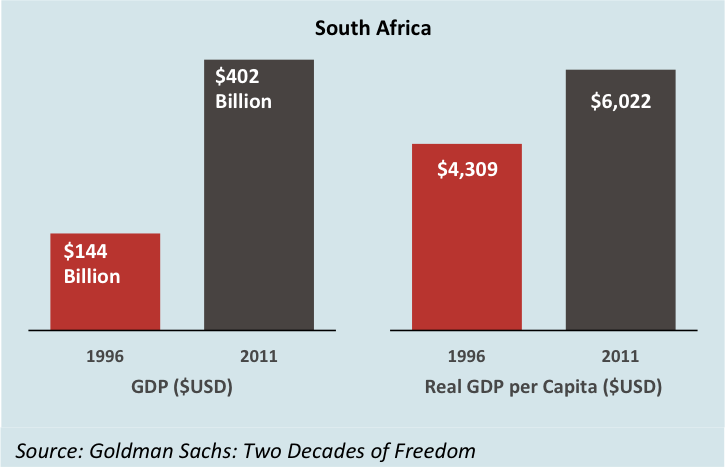

South Africa’s economy was severely hindered for many years by the economic sanctions many countries imposed because of the apartheid. However, when apartheid fell, the economic sanctions that were imposed on South Africa were lifted, and in the years since, the South African economy has made drastic improvements. Since the fall of apartheid, South Africa has managed to create a new sizeable African middle class, and increase its GDP by 40%.

Reigniting growth is possible by targeting the main industries, especially the service industry and mining. South Africa is the world’s largest producer of platinum automobile assembly, metalworking, machinery, textiles, iron and steel, chemicals, fertilizers, foodstuffs and commercial ship repair. The country’s main export partners are China, the U.S, Japan, Germany, India and the UK. On the other side, import partners are China, Germany, the U.S, Saudi Arabia, India, and Japan.

FinTech Overview

Fintech is the short form of Financial Technology, which is currently a rapidly growing industry in South Africa. Fintech is defined by the use of software to provide financial services. These services can include but are not limited to simplifying payment through the use of mobile phones and currency exchange to mobile wallets. The concept of Fintech is focused on the concept of disruption. Companies, often start-ups that focus on innovation, are classified as disruptors. They are known as disruptors because their innovation creates disruptions in the existing financial system that is less reliant on technology, often streamlining processes and making things easier for the consumer. The incumbents of the system that manage the financial systems are banks and as a result, the disruptions have forced the banks to adapt in response to this threat to their traditional business model. The banks have evolved through the use of new strategies such as partnerships, funding arrangements, mimicry of these disruptors, or even advancing their own technology. An example of a funding arrangement and partnership can be seen with TaxTim. This disruptor launched in 2011, introducing a simplified version of tax returns to reduce the need of costly accountants. In response, PwC partnered with TaxTim in 2015 as well as an unspecified funding arrangement with MMI Holdings, a financial services giant in 2016.

Albeit the economic challenges facing the country and Africa as a whole, the Fintech sector in Africa is poised for exponential and rapid growth, with South Africa spearheading its development and acting as a hub for booming Fintech startups. According to Frost & Sullivan Research, growth drives in South African Fintech include: reduced taxes on investment in startups, a steady increase in mobile use for mobile banking and payments, and a steady increase in the “digital” demographic, where we see mobile communications being embraced at a faster rate than other parts of the world. As country embracing technological adaptation with a growing middle class and high youth unemployment, South Africa's Fintech scene with emerging startups also creates an enormous market for jobs, not to mention its significant contribution to the country's economic and social development through innovation.

Existing South African financial institutions and banks are also beginning to understand the threat and opportunity that Fintech poses. In South Africa, we have already seen the emergence of Standard Bank’s WeChat Wallet. Like Standard Bank, many financial institutions have embraced open innovation as a way to explore these types of opportunities and understand how to make them relevant for the local market. One way this is being done is through the creation of startup accelerators and competitions to identify and support the country’s top fintech talent.

Barclays, for example, has launched Rise, its business incubator platform in Capetown in 2015. The bank went on to sign proof of concept partnerships with three African startups after the program. Accelerators programs such as Rise, and others created by institutions like U.S. based Techstars, and AlphaCode provide capital investment and funding, mentoring, and access to technical expertise and data to dozens of startups. Globally, technological investments in South Africa have the largest growth potential, including Walletdoc and WhereIsMyTransport, which raised 1.5 million in funding in 2016. Other firms of note include Impala Platinum holdings and Gateway communications.

Though in many respects the South African Fintech ecosystem is still in its infancy, it appears poised to growth and mature in the future. Given an incredibly vibrant startup ecosystem and support infrastructure from investors, government and private institutions, Fintech will likely continue to flourish in South Africa.