Energy Sector

Author: Christian Hall

Pakistan’s energy sector has existed since before the country’s own independence, derived from British colonialism. In 1988, Pakistan’s energy sector faced a financial crisis due to systematic problems within the division. As a result of the crisis, the government developed the Energy Sector Restructuring Program (ESRP) which included financial and governmental reforms to regain the viability of the sector as a whole. The Ministry of Water and Power was a main focus of the ESRP and is currently headed by Shahid Khaqan Abbasi. The ESRP, while meeting some of its objectives, ultimately failed and Pakistan’s energy sector is once again in crisis.

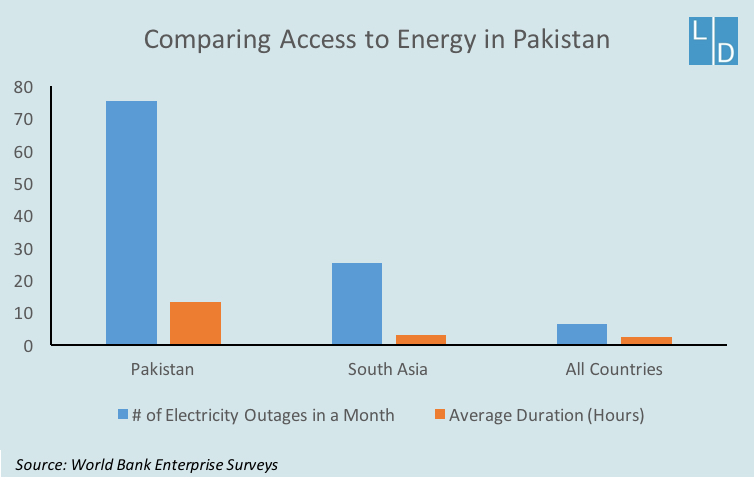

Pakistan has massive oil, petroleum and coal reserves which go largely untapped due to a lack of administrative effectiveness and infrastructure. As result Pakistan imports approximately 80 percent of its oil and petroleum. Although Pakistan has been benefiting from falling oil prices recently, it still spent $6.7 billion dollars on oil and petroleum imports between 2014 and 2015. Even with supplementary energy imports, Pakistan struggles to meet its domestic energy needs with 49 500 000 citizens presently without electricity and those who are connected to the grid suffer from rolling blackouts and load shedding. Currently, some of the largest companies include; The Pakistan State Oil Company which holds a 67% share in the fuel retail market; Pakistan Petroleum Limited (PPL) which established the natural gas market in Pakistan; the Oil and Gas Development Company (OGDCL) which is primarily owned by the government; and Shell Pakistan which is the oldest oil marketing company in the country.

The future of Pakistan’s energy sector shows great potential for growth as much of the sector’s shortcomings are resulting from lack of infrastructure and not lack of resources. Due in part to violent protests by citizens frustrated with rolling blackouts and load shedding, the Government of Pakistan has announced plans to create more liquid natural gas, and nuclear plants to alleviate power shortages by 2018. Additionally a syndicate of Chinese companies, via the China Pakistan Economic Corridor, has announced plans to invest $3 billion into Pakistan’s energy and communications sectors. Additionally, companies that do not benefit from the Chinese Pakistan Economic Corridor are primed to face massive competition from Chinese investors willing to front billions in capital investment in Pakistan’s energy sector. Finally, foreign companies seeking resource exploration permits are likely to face competition from already established companies like PPL and the OGDCL, which actively obtain new exploration permits. New investors should be cautious of Pakistan’s deeply flawed administrative mechanisms, which have recently led to the demise of what would have been one of the largest foreign investment deals in the country’s history. The foregone deal allowed Tethyan Copper Company to develop Pakistan’s copper and gold deposits in Reko Diq and would have come with a commitment of $3 billion. Administrative shortcomings, such as these, also make it hard for companies to enter the market.