Economic Implication's in Singapore's Biotechnology Industry

Team Leader: Mary Peplinski

Author: Adrian Yung

Singapore’s biotechnology industry has grown astronomically within the last decade. With Asia’s legal drug industry worth approximately $168 billion US dollars and growing at a rate of over 12 percent annually, there are abundant opportunities in the country for large pharmaceutical companies and top international researchers in the field, both of which play a major part in further increasing growth. This is heavily affected by the government’s continued allocation of resources and investment into the industry as well as the stability of the economy.

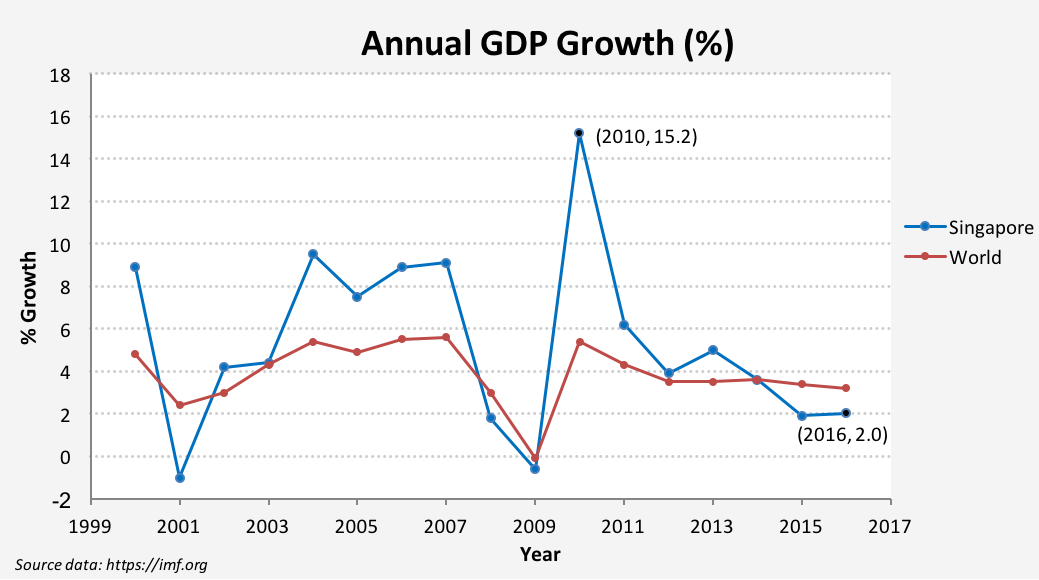

Since 2010, a year with a record high annual gross domestic product growth (GDP) of 15 percent, the number of local drug-development and related biotechnology has more than doubled with $1.5 billion Singapore dollars now spent annually on biomedical research. Accounting for around 5 percent of the total national GDP, the state of the biotechnology industry is inextricably linked to Singapore’s economy, which is estimated to grow by 2.9 percent in 2017 (compared to the worldwide average of 3.6 percent). Growth is then expected to slow down to an average of 2.5 percent a year from 2018 to 2022. However, this regression can be in part attributed to the economic slowdown of China and the United States, Singapore’s largest and fifth largest trade partners respectively.

The growth of Singapore’s economy and biotech industry allowed the government to support

Singapore has recently seen a sharp decrease in its annual GDP growth from a record 15 percent in 2010 down to below the world average at just 2 percent in 2016. The predicted economic growth slowdown might not only decrease available funding, grants, and awards for the numerous research institutions and scientists

Since 2011, pharmaceutical companies and researchers have started taking their leave from Singapore including cancer geneticists Neal Copeland and Nancy Jenkins who were part of the Institute of Molecular and Cell Biology (IMCB), and companies Novartis, GlaxoSmithKline, and Pfizer, which have a combined revenue of over $137 billion US. If Singapore wants to continue the growth of its biotech industry, it is essential to reverse the