A Looming Brexit and what that means for Investment in Pharmaceuticals

Team Leader: Haley Daniel

Research Analyst: Mayuran Sivakumaran

Keywords: Brexit, Pharmaceuticals, Healthcare, Investment, European Union

With 2018 approaching and no conclusive agreement between the UK and the EU, uncertainty has become the state of normalcy as everyone from workers to investors

Encouraging Signs

Considering the political turmoil that has encompassed the UK since the decision to leave the EU, the government has attempted to provide reassurance. In the public sphere, PM Theresa May has pledged to spend 160 million pounds on the healthcare sector, placing an emphasis on research and development as well as innovation in manufacturing. In addition to this, the government has also spent considerable time trying to attract investment from businesses, receiving more than 250 million pounds in funding.

Aside from public sector investment in the healthcare industry, the private sector has also played an increasingly important role and investment has seen a rise in 2017 despite Brexit concerns. The sector has grown significantly since 2014, as figures from the London Stock Exchange estimate the value at around 400 billion pounds. There have been several factors contributing to this substantial rise, mainly the large amounts of venture capital firms raising capital and investing in the industry. Furthermore, the growing amount of successful IPO’s for healthcare companies has contributed to the growth of the sector as a total of 1.96 billion pounds was raised in 2016.

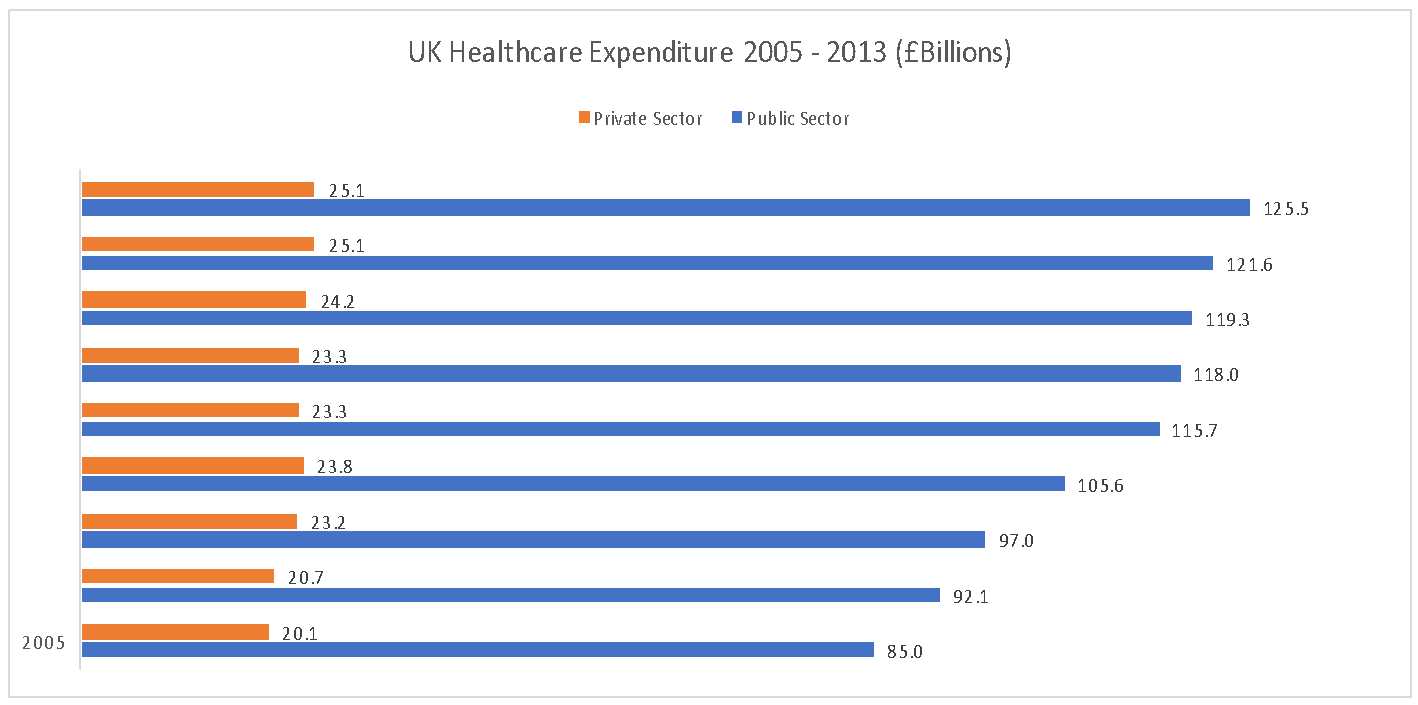

Source: Office for National Statistics

As seen in the graph above, from 2005 to 2013 investment and expenditure have seen an

Long-Term Risk

Though the UK government and private sector investors have increased their shares in the industry over the past year, one area of concern for the sector is the financing relationship it holds with the EU. The European Investment Bank (EIB) has provided lost cost capital to the National Health Service (NHS) in the form of €3.5

Mitigation Strategies

As the research shows, there has been improving investment in the pharmaceutical industry but a part of this can be tied back to the institutions of the EU. If the UK ends up with a hard or failed Brexit, there could be two mitigation strategies: continue to incentivize investors through increased public spending to reassure shareholders that the healthcare industry is of top priority to the government or to pursue a comprehensive trade deal such as the European Economic Area (EEA). With the EEA, the UK would still maintain ties with two important financiers -- the European investment bank and European investment fund -- and adopt EU legislation such as free trade and movement of capital and goods and services, but would not be able to vote in EU legislation.