The Imminent Collapse of the Real Estate Bubble in India

Team Leader: Marissa Vaillant

Main Contributor: Hannah Barltrop

Driven by growing population and economy India’s real estate market has been growing steadily for the better part of the last two decades, especially in economic hubs such as Mumbai, Delhi, and Kolkata. However, many economists, as well as real estate moguls, are concerned that sourcing difficulties and the increasing cost of financing are finally going to pop the “bubble.” Real estate prices are expected to drop over 50%, levels similar to the 2008 housing market crash in the United States.

The Role of the Reserve Bank of India

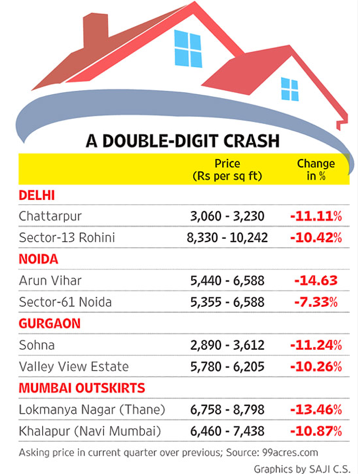

Changes in house prices in major Indian cities between Q3 2016 and Q2 2017

The recent demonetization of 500 and 1000 rupees notes by Prime Minister Narendra Modi is commonly being referred to as “the straw which broke the black money camel’s back” and has many concerned that a market collapse is imminent. In the residential market, a collapse has been on the horizon for years, with housing prices rising faster than annual income levels and banks becoming hesitant to provide mortgages for those which would have been denied only a few years back. The nervousness of Indian banks is a direct result of the Reserve Bank of India’s decision to push banks to resolve debts from larger defaulters and clean up their balance sheets by recognising non-performing assets, of which the second highest value is residential and commercial real estate. The Reserve is also promoting taking large accounts to a bankruptcy court for liquidation if amounts outstanding or time of which they have been outstanding exceed a certain threshold. This could lead to several large contracting companies and real estate developers facing legal action.

Changes in house prices in major Indian cities between Q3 2016 and Q2 2017

The lack of available financing and the high-interest rates for those who are able to secure it has been exerting pressure on the real estate market from nearly every angle. Residential buyers are unable to keep up with the rapid rise in housing prices, meaning contracting companies and developers are unable to secure deposits and down payments for units. Thus, both sides are asking banks for mortgages as well as short and long-term loans. In the commercial market, companies are rapidly expanding and are therefore demanding more commercial spaces (both in high-rises and factory space) and are driving up prices. Developers are struggling to find the cash and skilled labour to build fast enough to meet demand.

Running out of Space

Another threat to the “bubble” is the limited space in India’s major cities. Similar to economic hubs in the Western world such as New York City, London, and Toronto, space within the core of the city is limited, meaning prices within soar and people and companies alike are being forced onto the outskirts and neighbouring areas to secure space. The issue is, while they may be farther away from the city, price levels are still near or on pore with those in the city core. Customers are refusing to pay such high prices for a perceived lower value property. Consequently, there is an excess of supply in some areas, threatening to bring down the entire market if they do not sell soon.

Defaulting Developers

Defaulting developers are also a source of concern. Due to the high level of competition between developers, a massive accumulation of land occurred. Developers began using their land as leverage to negotiate deals for the land they actually wanted. Buying land for the sole purpose of buying it meant developers accumulated levels of debt they could not afford. The interest payments alone are threatening the financial stability of even medium-sized firms, while large players are barely managing to make instalments. This has left massive areas of usable land untouched, as developers can either not afford to pay for it to be developed or are saving it to use as a bargaining piece in future negotiations. Both of these strategies are contributing to the rising real estate prices and are on the cusp of triggering a collapse if even a couple large developers begin to default on their loans.

While the real estate market in India is still prospering, it is on the brink of a very large and costly collapse, estimated to be on par with the 2008 housing market collapse in the United States. Rising prices and demand have far surprised the economic growth India was experiencing, and when coupled with the Reserve Bank of India’s crackdown on banks and the demonetization of 500 and 1000 rupee notes, it is simply a matter of time before the “bubble” bursts.