Canadian Mining Companies Operating in Tanzania

Primary Analyst: Demyan Plakhov, Faizaan Jaffer

Team Leader: Marko Gombac

There are numerous companies currently invested in Tanzania’s mining sector. The largest foreign investors and corporate entities include: AngloGoldAshanti, Barrick Gold Corporation, Sky Associates Group, Shanta Gold, TanCoal, Petra Diamonds. South African firm AngloGoldAshanti is the third largest gold mining company in the world by production and owns the Geita gold mine. On the other hand, the case for Sky Associates Group is an odd one since the company previously held production licenses on the Merelani tanzanite mine. Sky Associates is a consortium of Tanzanian and Indian businessmen, registered in the British Virgin Islands. Two British firms, Shanta Gold and Petra Diamonds, own the New Luika gold mine and have production licenses for the Williamson diamond mine, respectively. TanCoal is a joint Tanzania-Australian firm, as it is an 100% owned subsidiary of Australia’s Intra Energy Corporation, that conducts operations through the Ngaka coal mine.

Another chief corporate entity in Tanzania happens to be the Canadian Barrick Gold Corporation, through the Acacia subsidiary, that owns Buzwagi, Bulyanhuku, and North Mara mines. More importantly, it claims to be the largest gold mining corporation on earth, and it is the only Canadian mining firm currently operating in Tanzania while other Canadian firms do not own any operating mines yet and are known as exploration or junior companies. A less significant Canadian player, yet still notable, is Midlands Minerals Tanzania. It is a subsidiary of its gold and diamond mining parent company, Midlands Minerals, which has six properties in Tanzania and Ghana. Although it has Itilima and Kilindi mining properties, it currently prioritizes its operations in Ghana.

Owner of three operating mines in Tanzania, Acacia Mining is the largest foreign direct investor in Tanzania for the past 15 years, with an investment of over $3BN USD. Acacia has also indirectly invested in the Tanzanian economy through Tanzanian employment. 96% of the 3,712 employees in Acacia’s Tanzanian-based operations are from Tanzania and earn, on average, 10 times that of the average wage in Tanzania.

The focus for all companies with mining interests in Tanzania, including Acacia Mining, is primarily gold. Acacia’s three mines operating in Tanzania - Buzwagi, North Mara, and most notably, Bulyanhulu - have proven gold reserves (in ounces) of 2.4 million, 3.8 million, and 13.2 million, respectively. Buzwagi and North Mara have annual productions of 225,000 and 269,000 ounces of gold, but their approximate remaining life-spans are only one and three years, respectively. Bulyanhulu, on the other hand, has an annual production of 330,000 ounces of gold and an approximate remaining lifespan of 21 years. Over the past decade that Acacia Mining has operated in Tanzania, it has produced over 9 million ounces of gold, thus directly impacting Barrick Gold, owner of 63.9% of Acadia’s shares, as 12% of Barrick Gold’s total revenue comes from Tanzanian gold.

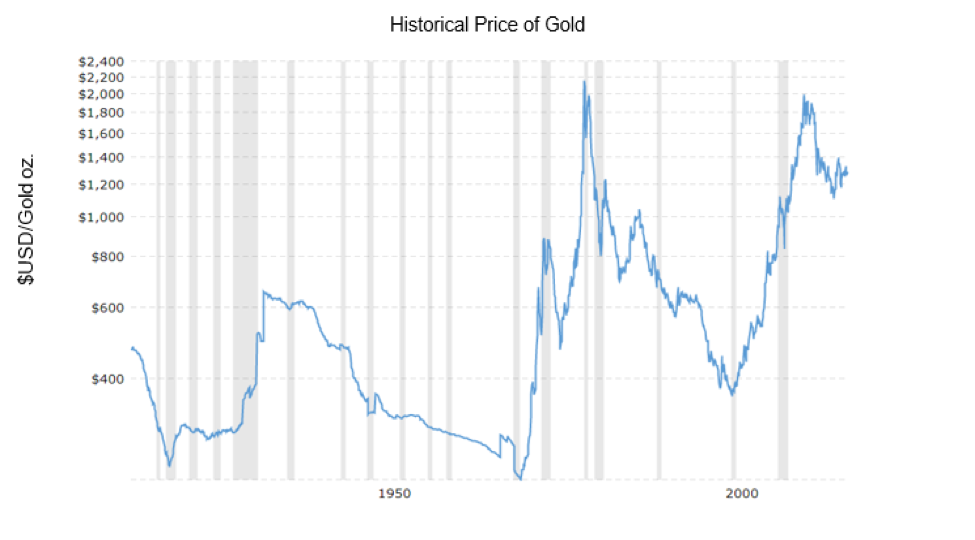

The vast wealth in gold that Tanzania has is both blessing and curse. Over-reliance on any one particular resource or asset exposes a country and any foreign investors to exogenous and internal risk. Exogenous risks include the variation in market prices for gold, which can be mitigated through diversification or hedging. Since Tanzania’s economy is concentrated on mining, diversification is difficult, especially when much of the economy relies on the gold industry to drive consumer spending. Below is a historical chart of gold prices that shows the price of gold in USD per oz. The upside here is that gold, as a historically well respected store of value and physical commodity, tends to be the asset of choice during times of increased political tension, which considering the current political climate, stands to favour Tanzania and investment in its economy. However, the more Tanzania builds off its gold rush, the more aggressively it will move to intervene in the economy if any foreign or internal perceived threats arise. Investors should mitigate this risk by running parallel corporate social responsibility (CSR) investments to ensure that their investment is diversified within the economy. This will make intervention from the government more disruptive and thus less likely to occur.

There are other Canadian firms, such as junior and exploration companies, with mining interests in Tanzania, who simply don’t have mines operating in Tanzania yet. The most notable of which would be Midlands Minerals Tanzania, a subsidiary of Midlands Minerals. The parent company, Midlands Minerals, focuses in gold and diamond mining. Though it has six gold and diamond properties in Tanzania, including the Itilima gold and diamond property and the New Kilindi gold property, Midlands Minerals is currently prioritizing its Ghanaian-based operations.

Poor relations between Acacia and the Tanzanian government are starting to match up with a recent trend in increasing restrictions on foreign investors in Tanzania. Tanzania has traditionally had a favourable operating environment for mining companies due to the Mining Act of 1998, which was created to try and attract foreign investment in mining. However, in recent years, the Tanzanian government has created problems for non-domestic mining firms by introducing strong regulations and penalties on mining firms, a policy that is broadly supported by the Tanzanian people.

The recent government decision in July 2017 billed Acacia with a substantial $190 billion USD for uncollected taxes and other fees, and the response to more recent problems of some top executives in leaving Acacia, signals the potential for a prolonged period of increased political risk in the mining sector of Tanzania.